Treasury Will Invoke â€ëœextraordinary Measures as Debt Ceiling Looms Again

Q&A: Everything You Should Know Most the Debt Ceiling

The federal debt ceiling will be reinstated on August 1, 2021, at effectually $28.5 trillion. At that point, the Treasury Section volition begin using bookkeeping tools at their disposal, chosen "boggling measures," to avoid defaulting on the authorities's obligations. The Treasury Department has estimated that these measures will exist exhausted as presently equally mid-to-belatedly-September, while the Congressional Budget Office (CBO), the Bipartisan Policy Center and other outside analysts predict exhaustion in the fall nearly the start of the next fiscal year (east.grand., likely September, October, or November). At that point, absent a new agreement to either raise or suspend the debt ceiling, the Treasury will be unable to go along paying the nation's bills. Congress could address the debt ceiling through reconciliation, which provides for passage of legislation with a unproblematic majority vote in the Senate.

- What is the debt ceiling?

- When was the debt ceiling established?

- How much has the debt ceiling grown?

- Why is Congress debating this now?

- What are boggling measures?

- Tin striking the debt ceiling be avoided without Congressional activity?

- What happens if the debt ceiling is hit?

- How does a shutdown differ from a default?

- Have policymakers used the debt ceiling to pursue deficit reduction in the past?

- What should policymakers do?

- What are the options for improving the debt ceiling?

- Where can I learn more?

- Appendix: Examples of How the Debt Ceiling Has Been Used in the By

What is the debt ceiling?

The debt ceiling is the legal limit on the total amount of federal debt the government can accrue. The limit applies to almost all federal debt, including the roughly $22.iii trillion of debt held past the public and the roughly $six.2 trillion the government owes itself as a result of borrowing from various regime accounts, like the Social Security and Medicare trust funds. Equally a result, the debt continues to ascension due to both annual budget deficits financed by borrowing from the public and from trust fund surpluses, which are invested in Treasury bills with the promise to be repaid afterwards with interest.

When was the debt ceiling established?

Prior to establishing the debt ceiling, Congress was required to approve each issuance of debt in a divide piece of legislation. The debt ceiling was first enacted in 1917 through the Second Liberty Bail Act and was prepare at $eleven.5 billion to simplify the process and raise borrowing flexibility. In 1939, Congress created the first aggregate debt limit roofing most all government debt and ready it at $45 billion, nigh 10 percent above total debt at the fourth dimension.

How much has the debt ceiling grown?

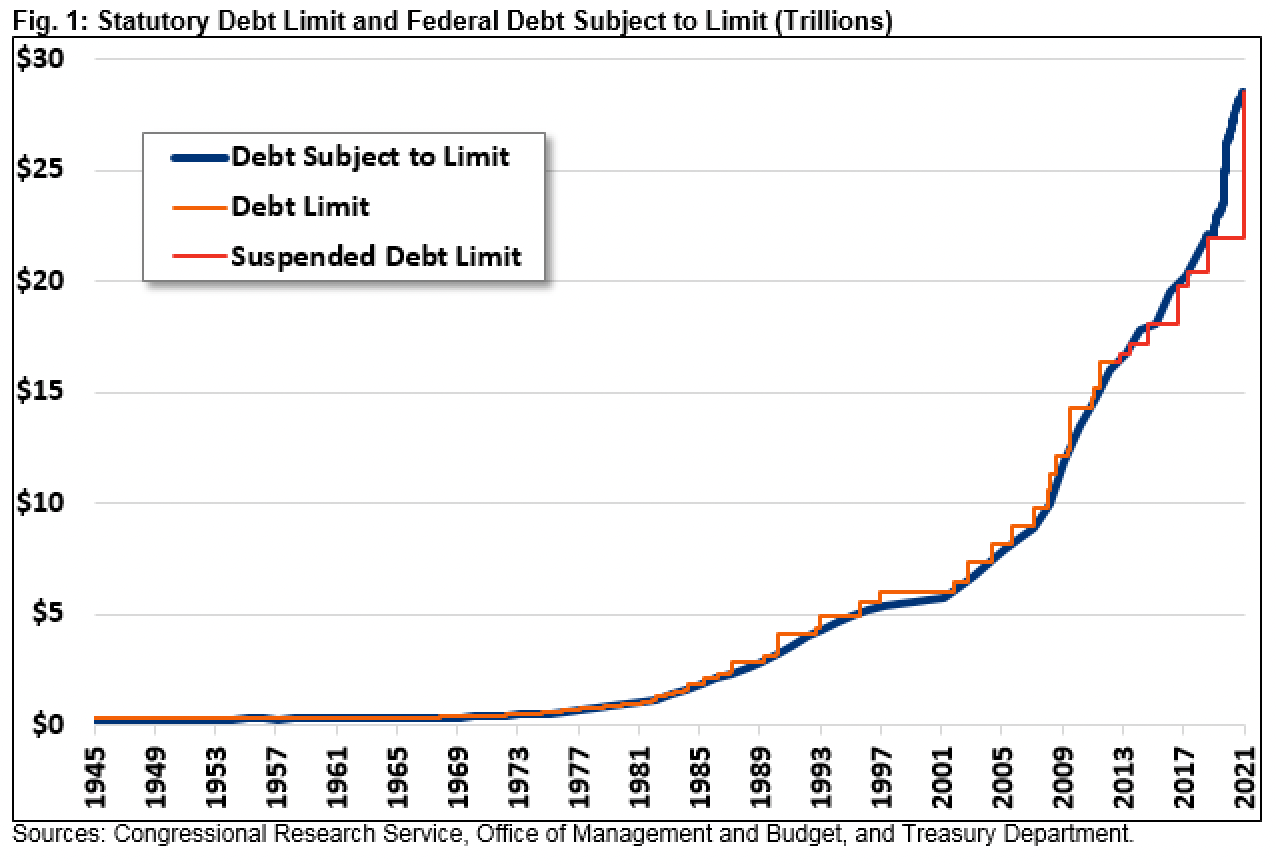

Since the finish of World State of war II, Congress and the President have modified the debt ceiling most 100 times. During the 1980s, the debt ceiling was increased from less than $i trillion to virtually $3 trillion. Over the class of the 1990s, it was doubled to nearly $vi trillion, and in the 2000s it was again doubled to over $12 trillion. The Upkeep Control Act of 2011 automatically raised the debt ceiling by $900 billion and gave the President potency to increase the limit by an additional $one.ii trillion (for a total of $2.1 trillion) to $16.39 trillion. Lawmakers accept suspended the debt limit vii times since February 2013. The most recent interruption began on August 2, 2019, and volition end on July 31, 2021.

Why is Congress debating this at present?

The debt ceiling is temporarily suspended through July 31, 2021, under the Bipartisan Budget Act of 2019.

In one case the debt ceiling is reinstated, it will be raised to the current debt level – effectually $28.5 trillion – pregnant the U.S. government will non exist able to issue any new debt.

Because government spending is projected to significantly exceed revenues this year and across, the government will not be able to avoid further increasing the debt ceiling. However, through the employ of so-called "extraordinary measures," the government tin can shift funds effectually and continue to pay its obligations on a temporary basis.

In a recent letter to Congressional leadership, Treasury Secretary Janet Yellen estimated that Treasury's extraordinary measures will last through Congress's Baronial recess – likely until mid-to-late September – with cash and extraordinary measures decreasing by near $150 billion on October 1 due to large mandatory payments. CBO estimates that extraordinary measures volition be exhausted sometime in the first quarter of the adjacent fiscal year (beginning October 1), in October or November. After this "X engagement," the U.S. would only be able to pay obligations with incoming receipts, forcing the Treasury to delay and/or miss many payments. A formal debt limit increase or intermission will exist necessary to avoid default.

What are extraordinary measures?

When the debt limit is reached, the Treasury Department uses a variety of accounting maneuvers, known every bit extraordinary measures, to avoid defaulting on the authorities'south obligations. For example, the Treasury has prematurely redeemed Treasury bonds held in federal employee retirement savings accounts (and replaced them after with involvement), halted contributions to sure authorities pension funds, suspended state and local government serial securities, and borrowed from money set aside to manage exchange rate fluctuations. The Treasury Section first used these measures in 1985, and they have been used on at least 15 occasions since then.

Can striking the debt ceiling be avoided without Congressional activity?

The Treasury Department'south use of extraordinary measures just delays when debt will reach the statutory limit. Spending in excess of incoming receipts has already been legally obligated; that spending volition push debt beyond the ceiling. There is no plausible set of changes that could generate the instant surplus necessary to avert having to raise or suspend the debt ceiling.

Some believe the Treasury Department could buy more than fourth dimension by engaging in other, unprecedented actions such equally selling big amounts of gilded, minting a special large-denomination money, or invoking the Fourteenth Amendment to override the statutory debt limit. Whether any of these tools is truly bachelor is in question, and the potential economical and political consequences of each of these options are unknown. Realistically, once extraordinary measures are exhausted, the only option to avoid defaulting on our nation'south obligations is for Congress to alter the constabulary to raise or suspend the debt ceiling.

What happens if the debt ceiling is hitting?

Once the government hits the debt ceiling and exhausts all available extraordinary measures, information technology is no longer allowed to result debt and presently later on volition run out of cash-on-hand. At that signal, given annual deficits, incoming receipts volition be insufficient to pay millions of daily obligations as they come up due. Therefore, the federal government volition have to at least temporarily default on many of its obligations, from Social Security payments and salaries for federal civilian employees and the military to veterans' benefits and utility bills, amongst others.

A default, or even the perceived threat of one, could have serious negative economical implications. An actual default would roil global financial markets and create chaos, since both domestic and international markets depend on the relative economic and political stability of U.S. debt instruments and the U.Due south. economy. Interest rates would ascent, and demand for Treasuries would drop equally investors end or calibration back investments in Treasury securities if they are no longer considered a perfectly condom investment, thereby increasing the run a risk of default. Even the threat of default during a standoff increases borrowing costs. The Government Accountability Office (GAO) estimated that the 2011 debt ceiling standoff raised borrowing costs by a full of $1.three billion in Fiscal Twelvemonth (FY) 2011, and the 2013 debt limit impasse led to additional costs over a 1-twelvemonth period of between $38 million and more than $70 million.

If involvement rates for Treasuries increase substantially, interest rates beyond the economy would follow, affecting motorcar loans, credit cards, habitation mortgages, business investments, and other costs of borrowing and investment. The balance sheets of banks and other institutions with big holdings of Treasuries would pass up every bit the value of Treasuries dropped, potentially tightening the availability of credit equally seen most recently in the Great Recession.

How does a shutdown differ from a default?

A shutdown occurs when Congress fails to pass appropriations bills that permit agencies to obligate new spending. Every bit a event, the authorities temporarily stops paying employees and contractors who perform government services (see Q&A: Everything You Should Know About Government Shutdowns). Still, many more parties are non paid in a default. A default occurs when the Treasury does not take enough cash bachelor to pay for obligations that have already been made. In the debt ceiling context, a default would be precipitated by the government exceeding the statutory debt limit and being unable to pay all of its obligations to its citizens and creditors. Without plenty coin to pay its bills, any of the payments are at risk, including all authorities spending, mandatory payments, interest on our debt, and payments to U.S. bondholders. While a government shutdown would exist disruptive, a authorities default could be disastrous.

Have policymakers used the debt ceiling to pursue deficit reduction in the past?

Although policymakers take often enacted "clean" debt ceiling increases, Congress has also coupled increases with other legislative priorities. In a number of cases, Congress has attached debt ceiling increases to upkeep reconciliation legislation and other deficit reduction policies or processes.

Indeed, most of the major deficit reduction agreements made since 1980 accept been accompanied by a debt ceiling increase, although causality has moved in both directions. On some occasions, the debt limit has been used successfully to assistance prompt deficit reduction, and in other cases, Congress has tacked on debt ceiling increases to deficit reduction efforts. For example, the 2011 Upkeep Control Human activity was enacted along with a debt ceiling increment, as were the Gramm-Rudman-Hollings Balanced Upkeep and Emergency Deficit Control Act of 1985.

In nearly all instances in which a debt limit increase was either accompanied past deficit reduction measures or included in a arrears reduction package, lawmakers accept more often than not approved temporary increases in the debt limit to permit time for negotiations to be completed without the risk of default. For case, Congress canonical a pocket-sized increment in the debt limit in December 2009 while negotiations over Statutory Pay-As-You-Go (PAYGO) and the institution of the National Commission on Fiscal Responsibleness and Reform were ongoing. Similarly, during the negotiations and consideration of the 1990 budget agreement, Congress approved six temporary increases in the debt limit before approval a long-term increase as part of the reconciliation nib implementing the deficit reduction agreement.

The Appendix contains further give-and-take of provisions attached to debt ceiling legislation, including bills in 1993, 1997, 2013, 2015, 2018, and 2019.

What should policymakers practice?

Policymakers should work promptly to heighten or suspend the debt ceiling. Failing to heighten the debt ceiling would be disastrous. Information technology would result in severe negative consequences that experts are non capable of predicting in advance. Even threatening a default or taking the country to the brink of default could have serious implications. Chiefly, though, declining to command the national debt would likewise have negative consequences; rising debt could ultimately stunt economic growth, reduce fiscal flexibility, and increase the cost brunt on hereafter generations. Thus, lawmakers should consider accompanying a debt ceiling increase with measures to begin addressing the debt.

To be sure, political advantage should non be sought by threatening default, and the debt ceiling must be raised or suspended as shortly as possible. Lawmakers must non jeopardize the full faith and credit of the U.S. government. At the same time, the need to raise the debt ceiling tin can serve as a useful moment for taking stock of our fiscal land and for pursuing revenue increases, entitlement reform, and/or spending reductions.

What are the options for improving the debt ceiling?

Increasing the debt ceiling requires frequent and frequently contentious legislative activeness. While a number of increases have been used to enact fiscal reforms, many increases are not necessarily tied to financial health. For instance, debates regarding the debt ceiling often take place after the policies producing the debt have already been put in place. The debt ceiling too measures gross debt, which means that even if the budget was counterbalanced, the debt ceiling would nevertheless take to exist raised if surpluses accumulated in government trust funds like Social Security.

In The Better Budget Process Initiative: Improving the Debt Limit and subsequent publications, we take suggested reforms to the debt ceiling, grouped in 4 major categories:

- Linking changes in the debt limit to achieving responsible fiscal targets, so that Congress would not need to increase the debt ceiling if fiscal targets are met.

- Having argue virtually the debt limit when Congress is making decisions on spending and revenue levels, non afterward those decisions accept been made.

- Applying the debt limit to more than economically meaningful measures, such every bit debt held past the public or debt equally a share of Gdp.

- Replacing the debt limit with limits on future obligations.

Where can I learn more than?

- Committee for a Responsible Federal Budget – Understanding the Debt Limit

- Committee for a Responsible Federal Budget – Improving the Debt Limit

- Bipartisan Policy Centre – Debt Limit Analysis

- Bipartisan Policy Center – BPC Warns Debt Limit "X Engagement" Will Be Particularly Difficult to Forecast

- Government Accountability Office – Debt Limit: Assay of 2011-2012 Actions Taken and Effect of Delayed Increase on Borrowing Costs

- Authorities Accountability Office – Debt Limit: Market Response to Recent Impasses Underscores Demand to Consider Culling Approaches

- Congressional Budget Office – Federal Debt and the Statutory Limit, July 2021

- Congressional Research Service – The Debt Limit

- Congressional Research Service – The Debt Limit Since 2011

- Congressional Research Service – Reaching the Debt Limit

- Treasury Section – Frequently Asked Questions About the Public Debt

- Treasury Department – Clarification of Boggling Measures, March 2019

- Treasury Department – Yellen Sends Debt Limit Letter to Congress

Appendix: Examples of How Debt Ceiling Has Been Used in the By

The Gramm-Rudman-Hollings Act in 1985: The Gramm-Rudman-Hollings Deed (GRH) in 1985 raised the debt limit past $175 billion and besides set a target to have a balanced upkeep past 1991, with all-embracing cuts in spending past sequestration designed equally an enforcement mechanism. Although the deficit reduction goals under GRH were not fully achieved, the experience gained nether the human activity contributed to the development of more workable and effective procedures 5 years later.

The Balanced Upkeep and Emergency Deficit Control Reaffirmation Deed of 1987: This bill, too known equally Gramm-Rudman-Hollings II, was passed to correct constitutional deficiencies in the 1985 Gramm-Rudman-Hollings Human action. Like its predecessor, GRH II attached a arrears reduction mensurate to the increased debt limit, requiring automatic sequester if deficits did not meet annual targets.

Omnibus Budget Reconciliation Act of 1990: The Omnibus Budget Reconciliation Act (OBRA) of 1990 raised the debt limit by $915 billion, the largest increase up until that indicate, but it also contained most $500 billion in arrears reduction over the next 5 years. Additionally, it created enforcement procedures in the Budget Enforcement Act (BEA), which helped lead to upkeep surpluses in the tardily 1990s. The BEA too created adjustable limits for separate categories of discretionary spending and the pay-as-you-go (PAYGO) process that required taxation cuts or increases in mandatory spending to be first. Congress approved half dozen temporary increases in the debt limit while negotiations to implement the budget agreement were ongoing.

Omnibus Upkeep Reconciliation Act of 1993: The Motorbus Budget Reconciliation Act of 1993 raised the debt limit past $600 billion, an increment that lasted for about 2 and a half years. OBRA '93 was the second major deficit reduction package of the 1990s, also containing virtually $500 billion in deficit reduction over five years. The agreement extended the original spending caps from 1990 and raised taxes on loftier earners, amongst other reforms.

Line Item Veto Act of 1996: The Line Detail Veto Act of 1996 gave the President authorization to veto specific provisions in legislation that increased the federal arrears, increased entitlement spending over the baseline, created revenue enhancement benefits, or allocated discretionary budget authorisation. This practice, known as a line-item veto, was ruled unconstitutional by the Supreme Court for violating the separation of powers clause by allowing the President to meliorate a statute without Congress voting on it. While the 1996 line-detail veto was plant unconstitutional, other versions of information technology have been presented, including one past President Bush that would have allowed him to cancel spending obligations using his existing rescission authority.

Counterbalanced Budget Act of 1997: The Balanced Budget Act of 1997 included a $450 billion debt limit increment that, thanks to the surpluses of the tardily 1990s and early 2000s, was enough to cover debt until 2002. At the time, the legislation called for about $125 billion of net deficit reduction over v years and $425 billion over ten years. It did and so mainly through reductions in health care spending via provider payment reductions and increased premiums. The Human action also created a few new programs – Medicare+Choice (later renamed Medicare Advantage or Medicare Part C) and the State Children's Health Insurance Plan (CHIP).

Statutory PAYGO Act of 2010: The Statutory PAYGO Human action of 2010 contained a debt limit increase of $1.nine trillion, the largest nominal increase ever enacted until that point in time. In exchange for the debt limit increase, this legislation included a budget process reform that reinstituted statutory PAYGO procedures that require taxation cuts and mandatory spending increases to be fully outset (with some exemptions). Informally, the agreement to raise the debt ceiling also led to the creation of a National Commission on Fiscal Responsibility and Reform (also known every bit the Simpson-Bowles commission).

Budget Control Human action of 2011: The Budget Control Act (BCA) gave the President the authority to increase the debt limit in tranches – discipline to a Congressional motion of disapproval – by a total of $2.1 trillion. The BCA too independent $917 billion in deficit reduction over ten years, primarily through caps on discretionary spending. In improver, the bill established the Joint Committee on Deficit Reduction ("Super Commission") to produce deficit reduction legislation of at least $ane.2 trillion in savings, without which budget sequestration would begin in 2013 as a consequence of the Super Commission declining to succeed. The Super Committee did not produce such legislation, resulting in years of budget sequestration. The bill also required Congress to vote on a Counterbalanced Budget Amendment, which it did not laissez passer.

No Budget, No Pay Act of 2013: Lawmakers enacted the No Upkeep, No Pay Act in early Feb 2013, which temporarily suspended the debt ceiling through May eighteen, 2013 and so ready an automatic "grab upward" on May 19 that allowed for a $300 billion increase in the debt ceiling. The understanding would have also withheld the pay of Members of Congress if no budget resolution was passed in each House (though there was no requirement that the resolution be agreed to jointly, which is necessary to prefer a single Congressional upkeep.).

Default Prevention Deed of 2013: The Default Prevention Act of 2013 ended a 16-day partial shutdown of the federal authorities by funding the regime through January 15, 2014 and suspending the debt ceiling until February 7, 2014. This agreement prepare up a bicameral budget conference to reconcile budgets for FY 2014 and provided for an automatic "take hold of up" on February seven. On that engagement, the debt ceiling was reinstated at the current level of borrowing, resulting in a de facto increment of well-nigh $500 billion and bringing the debt ceiling to $17.ii trillion.

Bipartisan Upkeep Act of 2015: This bill suspended the debt limit through March 15, 2017 and provided an automated "catch upwardly" to account for borrowing up to that betoken that will effectively heighten the debt limit by $1.8 trillion to its electric current level of $19.8 trillion. The pecker likewise enacted "sequester relief" past raising the statutory caps on defence force and nondefense discretionary spending for FY 2016 and FY 2017 (partially offset past mandatory savings) and averted insolvency of the Social Security Inability Insurance Trust Fund by reallocating payroll tax revenues.

Bipartisan Budget Act of 2018: This bill suspended the debt limit through March 1, 2019 and provided for an automatic "catch up" to account for borrowing up to that point that will effectively raise the debt limit by $ane.v trillion to its anticipated level of approximately $22 trillion. The beak likewise raised statutory caps on defense and nondefense discretionary spending in 2018 and 2019 beyond the original 2011 caps. Little of the bill'southward toll was get-go; it ultimately will add together $418 billion to the debt after ten years, after accounting for increased interest costs.

Bipartisan Budget Human activity of 2019: This neb suspended the debt limit through July 31, 2021, and provided for an automatic "grab up" to account for the borrowing upwardly to that point. That will effectively raise the debt limit by $half dozen.5 trillion to its anticipated level of approximately $28.5 trillion. The bill also raised statutory caps on defense and nondefense discretionary spending in 2020 and 2021 by about $320 billion. Only a portion of the beak's cost was kickoff; it ultimately will add $i.7 trillion to the debt over x years after accounting for longer-term increases to baseline discretionary spending levels stemming from the bill.

Source: https://www.crfb.org/papers/qa-everything-you-should-know-about-debt-ceiling

0 Response to "Treasury Will Invoke â€ëœextraordinary Measures as Debt Ceiling Looms Again"

إرسال تعليق